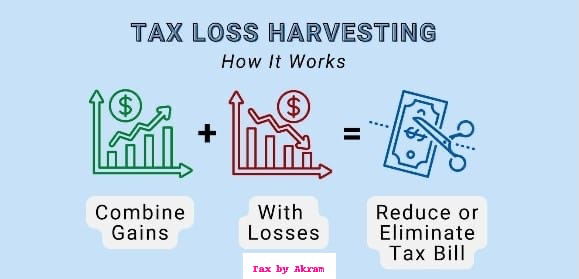

Tax Loss Harvesting: A Smart Way to Save Taxes & Optimize Investments

Tax harvesting helps you reduce taxable capital gains while keeping your investments intact. Here's how you can make the most of this strategy:

Step 1: Offset Losses to Reduce Tax

**Example:** You made a ₹50,000 profit from selling a stock, but you also hold another stock at a ₹30,000 loss.

**Solution:** Sell the loss-making stock to reduce your taxable gain to ₹20,000 (₹50,000 - ₹30,000).

**Benefit:** You pay tax only on ₹20,000 instead of ₹50,000!

Step 2: Increase Cost of Acquisition (COA) for Future Tax Savings

**Example:** Bought a stock at ₹200, now it's ₹250.

**Strategy:** Sell at ₹250 (book profit) and buy back at ₹250.

**New COA:** ₹250 instead of ₹200.

**Benefit:** When you sell later at ₹300, taxable gain is only ₹50 (₹300 - ₹250) instead of ₹100 (₹300 - ₹200)!

Step 3: Utilize the ₹1,25,000 LTCG Exemption

**Example:** Your long-term capital gain (LTCG) for the year is ₹1,75,000.

**Strategy:** Sell loss-making stocks to reduce LTCG to ₹1,25,000, which is fully tax-free!

**Benefit:** Save tax while staying invested in the market.

Final Benefits of Tax Harvesting

Important Considerations

**Wash Sale Rule:** In India, you can immediately buy back the same stock after selling (unlike the US 30-day rule). This makes tax harvesting more flexible.

**Timing:** Best done at year-end (January-March) to assess your total capital gains for the financial year.

**Documentation:** Maintain detailed records of all transactions, including buy/sell dates, prices, and quantities for ITR filing.

Who Should Use Tax Harvesting?

This strategy is ideal for:

Real-World Example

Raj's Portfolio:

**Total Gains:** ₹1,30,000

**Strategy:** Sell Stock B to book ₹60,000 loss, reducing net gains to ₹70,000 (below ₹1,25,000 exemption). Buy back Stock B immediately if fundamentals are strong.

**Result:** Zero tax on ₹70,000 gains + Reset COA for Stock B for future tax efficiency!

**Stay tax-smart with TaxByAkram** – Maximize your returns, minimize your taxes!

Found this helpful? Share it with others!

Need personalized tax advice?

Every situation is unique. Let's discuss your specific case and find the best tax-saving strategies for you.

Chat on WhatsApp