New Tax Regime vs Old Regime: Which One to Choose in 2024?

New Tax Regime vs Old Regime: Which One to Choose in 2024?

Budget 2023 made the new tax regime the default option. But is it better for you? Let's break it down.

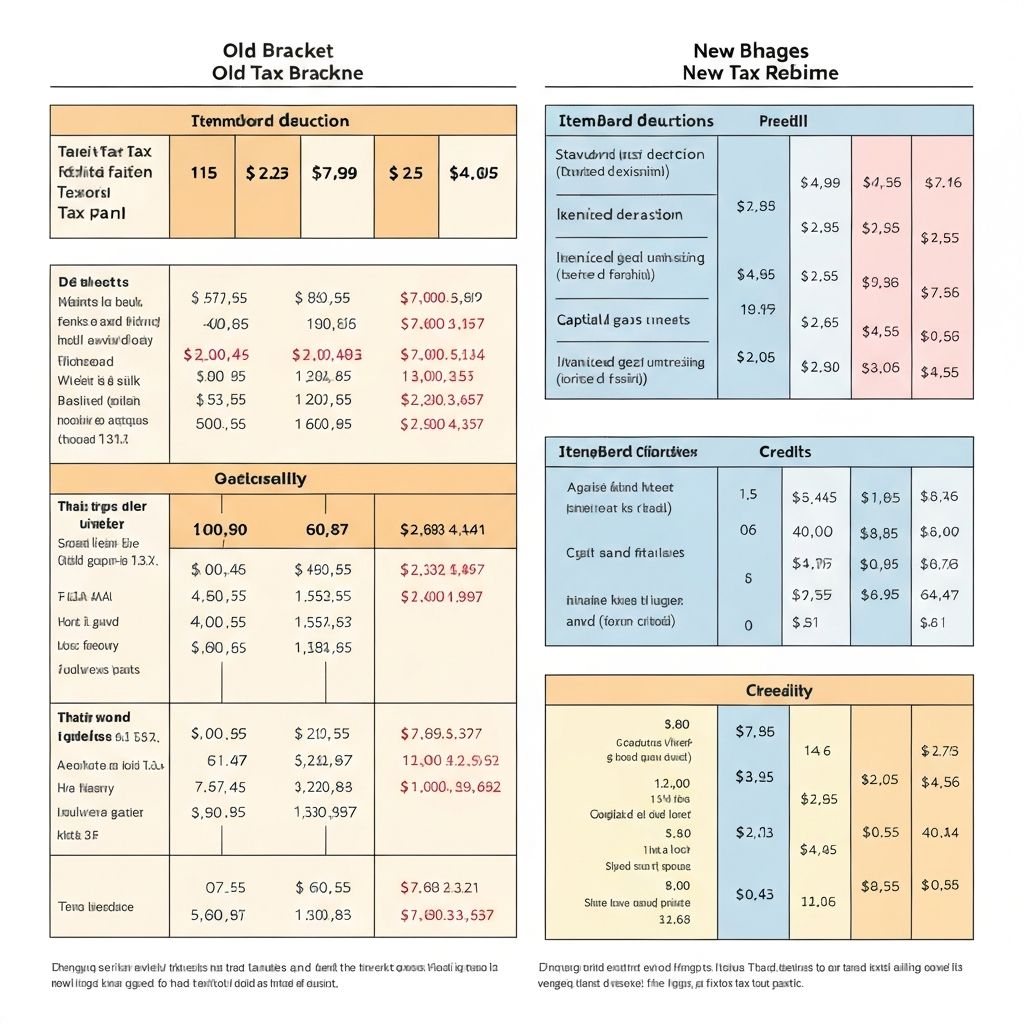

Old Tax Regime - Tax Slabs

**Plus:** All deductions under 80C, 80D, HRA, etc.

New Tax Regime - Tax Slabs (2024)

**Minus:** No deductions allowed (except standard deduction of ₹50,000 for salaried)

When to Choose Old Regime

Choose old if you:

**Example:** Income ₹10L, Investments ₹2L

When to Choose New Regime

Choose new if you:

**Example:** Income ₹8L, No investments

Can You Switch?

My Recommendation

Most salaried professionals with investments benefit from the old regime. However, if your income is under ₹10 lakhs and you don't invest much, the new regime saves you money.

**Not sure which one is right for you?** Let me calculate both scenarios for your specific situation and help you choose wisely.

Found this helpful? Share it with others!

Need personalized tax advice?

Every situation is unique. Let's discuss your specific case and find the best tax-saving strategies for you.

Chat on WhatsApp